Saturday, 24 March 2018

Instructions for the purchase of laptops, notebooks and similar devices for eligible officers revised guideline

Instructions for the purchase of laptops, notebooks and similar devices for eligible officers revised guideline

F.No. 08(34)/201 7-E II(A)

Ministry of Finance

Department of Expenditure

E.II(A). Branch

New Delhi, the 20th February, 2018

OFFICE MEMORANDUM

Subject: Instructions for the purchase of laptops/notebooks and similar devices for eligible officers - revised guidelines.

In supersession to this Ministry's Office Memorandum bearing No. 08(64)/2017-E.II(A) dated 27th September 2016, regarding purchase of Note Book/Lap-Top computers by Ministries/ Departments & delegation of powers thereof, it has been decided that laptop; tablet; notepad; ultra-book; notebook, net-book or devices of similar categories may be issued to officers of the rank of Deputy Secretary and above for discharge of official work. These powers shall continue to be exercised in consultation with the Financial Adviser by the Secretary of the Ministry/ Department or any other authority who are specifically delegated these powers by this Ministry from time to time, duly taking into consideration the functional requirements and budgetary provisions.

2. This would, however, be subject to the following conditions:

(i) Cost of device: The Cost of device including Standard software shall not exceed Rs. 80,000/-

Standard Software: Any software (Operating System, Antivirus software or MS-Office etc.) that is essential for the running of device towards discharge of official functions/duties.

(ii) Purchase Procedures: As prescribed under GFRS/CVC guidelines may be followed.

(iii) Safety, Security & Maintenance of Device: The officer, who is given the device, shall be personally responsible for its safety and security as well as security of data/information, though the device shall continue to remain Government property. The officer concerned will be at liberty to get the device insured at his personal cost.

(iv) Retention/Replacement of device:

a) No new device may be sanctioned to an officer, who has already been allotted a device, in a Ministry /Department, up to five years. Any further issue of laptop in case of loss/damage beyond repairs within the prescribed period, should be considered only after the cost is recovered from the officer based on the book value after deducting the depreciation.

b) For the purpose of calculation of the book value, a depreciation of 25% per year, on straight line method, be adopted.

c) Post the completion of five years of usage, the officer shall retain the issued device.

(v) Conditions at the time of transfer, Superannuation etc.:

a) ln case where, at the time of purchase of device if the residual service of the officer is less than 5 years or in case the officer is transferred/deputed to State Govt. but with residual service of less than 5 years or the officer leaves the Government Service within 5 years of purchase of such device, the officer concerned will have the option of retaining the device by paying the amounl after deducting the depreciation.

b) Upon transfer/deputation of the officer to other Ministry/ Department Attached/ Subordinate offices of the Government of India or to the State Government in case of Officers of the All India Services, the officer will have the option of retaining the existing device and in case of such retention, this fact should be specifically mentioned in the Last Pay Certificate (LPC).

3. Instructions for Ministries/Departments:

(i) For the officials who are currently holding laptops, notebooks or similar devices in accordance with the provisions of O.M. dt. 27/09/2016, the terms & conditions for retention/disposal of the device shall continue to be governed under the existing instructions of the said O.M.

(ii) The applicability of the provisions of this order to the officers of Armed Forces / Para-Military Forces, officers of MoD & other similar establishments would be subject to restrictions imposed by the concerned departments/organizations duly taking into consideration the security of information. In all such cases the security of the information shall be the responsibility of the concerned department.

4. This is issued with the approval of Secretary (Expenditure).

(Dr. Bhartendu Kumar Singh)

Director (E.IIA)

Thursday, 22 March 2018

Tuesday, 20 March 2018

Monday, 19 March 2018

Friday, 16 March 2018

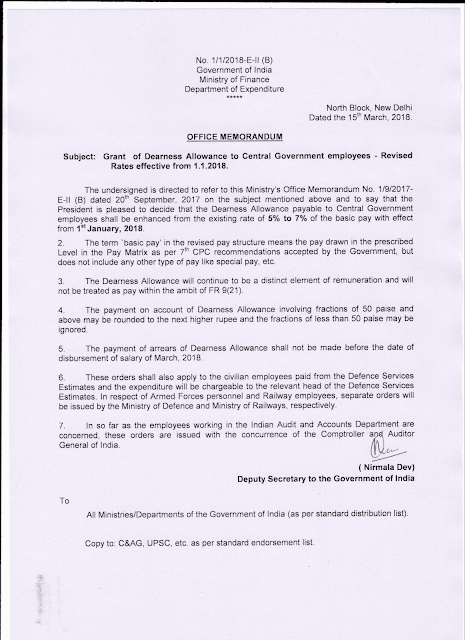

Grant of Dearness Allowance to Central Government Employees - Revised rates from 01.01.2018

Grant of Dearness Allowance to Central Government Employees - Revised rates from 01.01.2018

DOWNLOAD Original order

Wednesday, 14 March 2018

Time-limit for submission of claims for Travelling Allowances

Time-limit for submission of claims for Travelling Allowances

No. 19030/1/2017-E.IV

Government of India

Ministry of Finance

Department of Expenditure

***

Ministry of Finance

Department of Expenditure

***

New Delhi, the 13th March, 2018

OFFICE MEMORANDUM

Sub: Time-limit for submission of claims for Travelling Allowances — regarding.

Consequent upon the issuance of General Financial Rule (GFR)-2017, vide Rule 290 of GFR-2017, time-limit for submission of claim for Travelling Allowance (TA) has been changed from one year to sixty days succeeding the date of completion of the journey. Accordingly, in supersession of this Department’s OM NO. F.5(16)-E.IV(B)/67 dated 13.06.1967 & OM No. 19038/1/75-E.IV (B) dated 18.02.1976, it has been decided with the approval of Competent Authority that the claim of a Govt. servant to Travelling Allowance/Daily Allowance on Tour/Transfer/Training/Journey on Retirement, is forfeited or deemed to have been relinquished if the claim for it is not preferred within sixty days succeeding the date of completion of the journey.

2. In respect of claim for Travelling Allowance for journey performed separately by the officer and members of his family, the dates should be reckoned separately for each journey and the claim shall be submitted within sixty days succeeding the date of completion of each individual journey. Similarly, TA claims in r/o transportation of personal effects and conveyance shall be submitted within sixty days succeeding the date on which these are actually delivered to the Govt. servant at the new station.

3. The date of submission of the claims shall be determined as indicated below:

1.

|

In the case of Officers who are their own The date of presentation of the claim at the

Controlling Officer.

|

Treasury/Cash Section.

|

2.

|

In the case of Officers who are not their own

Controlling Officer. |

The date of submission of the claim to the Head of Office/Controlling Officer.

|

4. In the case of claims falling under category 3(ii), which are presented to the Treasury after a period of sixty days succeeding the date of completion of journey, the date of submission of the claim will be counted from the date when it was submitted by the Govt. servant to the Head of Office/ Controlling Officer within prescribed time-limit of sixty days.

5. A claim for Travelling Allowance of a Govt. servant which has been allowed to remain in

abeyance for a period exceeding one year should be investigated by the Head of the Department concerned. if the Head of Department is satisfied about the genuineness of the claim on the basis of the supportive documents and there are valid reasons for the delay in preferring the claims, the claims should be paid by the Drawing and Disbursing Officer or Accounts Officer, as the case may be, after usual checks.

abeyance for a period exceeding one year should be investigated by the Head of the Department concerned. if the Head of Department is satisfied about the genuineness of the claim on the basis of the supportive documents and there are valid reasons for the delay in preferring the claims, the claims should be paid by the Drawing and Disbursing Officer or Accounts Officer, as the case may be, after usual checks.

6. These orders are not applicable in r/o Leave Travel Concession (LTC) claims which are governed by separate set of rules of DoPT.

7. These orders shall be effective from the date of issue of this O.M.

8. In so far as the persons serving in the Indian Audit & Accounts Department are concerned, this order issues in consultation with the Comptroller & Auditor General of India.

S/d,

(Nirmala Dev)

Deputy Secretary to the Government of India

(Nirmala Dev)

Deputy Secretary to the Government of India

To,

All Ministries/Departments of the Govt. of India etc. as per standard distribution list.

DOWNLOAD Signed copy.

All Ministries/Departments of the Govt. of India etc. as per standard distribution list.

DOWNLOAD Signed copy.

Tuesday, 13 March 2018

SB Order No.03/2018 - Prevention of Frauds

SB Order No.03/2018 - Prevention of Frauds

F.No.113-01/2017-SB

Government of India

Ministry of Communications

Department of Posts

F.No.113-01/2017-SB

Government of India

Ministry of Communications

Department of Posts

Dak Bhawan, Sansad Marg,

New Delhi-110 001

Dated: 12.03.2018

To,

All Heads of Circles/Regions

Addl. Director General, APS, New Delhi.

Subject:-Prevention of Frauds

Respected Sir / Madam,

The undersigned is directed to refer to the Sr. DDG & CVO, Department of

Posts,Dak Bhawan, New Delhi, D.O. No.4-102/WB-08/2017-Inv dated 16.02.2018

addressed to the Circles, with copy marked to this Division and to say that various

guidelines/orders/instructions as well as SB Order have been issued to the Circles

from this end from time to time to ensure preventive vigilance in POSB/CBS for

prevention/early detection of Frauds. lt is once again requested to take up it as a

very important issue & to ensure necessary action in this regard. Vigilance Dn. has

given special emphasis on the following points:-

A) The PMLA alert are important & action thereon should be taken very

attentively & carefully at field level.

B) The 100% verification of SB transaction should be invariably done through

MIS server by SBCO as prescribed.

2. It is requested to circulate this to all concerned immediately for necessary

action accordingly.

This issues with the approval of competent authority.

Yours Sincerely,

(P L Meena)

Assistant Director (SB-I)