Monday, 19 March 2018

Friday, 16 March 2018

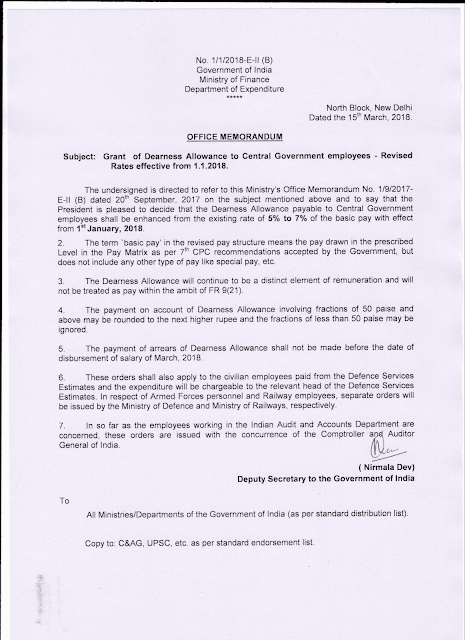

Grant of Dearness Allowance to Central Government Employees - Revised rates from 01.01.2018

Grant of Dearness Allowance to Central Government Employees - Revised rates from 01.01.2018

DOWNLOAD Original order

Wednesday, 14 March 2018

Time-limit for submission of claims for Travelling Allowances

Time-limit for submission of claims for Travelling Allowances

No. 19030/1/2017-E.IV

Government of India

Ministry of Finance

Department of Expenditure

***

Ministry of Finance

Department of Expenditure

***

New Delhi, the 13th March, 2018

OFFICE MEMORANDUM

Sub: Time-limit for submission of claims for Travelling Allowances — regarding.

Consequent upon the issuance of General Financial Rule (GFR)-2017, vide Rule 290 of GFR-2017, time-limit for submission of claim for Travelling Allowance (TA) has been changed from one year to sixty days succeeding the date of completion of the journey. Accordingly, in supersession of this Department’s OM NO. F.5(16)-E.IV(B)/67 dated 13.06.1967 & OM No. 19038/1/75-E.IV (B) dated 18.02.1976, it has been decided with the approval of Competent Authority that the claim of a Govt. servant to Travelling Allowance/Daily Allowance on Tour/Transfer/Training/Journey on Retirement, is forfeited or deemed to have been relinquished if the claim for it is not preferred within sixty days succeeding the date of completion of the journey.

2. In respect of claim for Travelling Allowance for journey performed separately by the officer and members of his family, the dates should be reckoned separately for each journey and the claim shall be submitted within sixty days succeeding the date of completion of each individual journey. Similarly, TA claims in r/o transportation of personal effects and conveyance shall be submitted within sixty days succeeding the date on which these are actually delivered to the Govt. servant at the new station.

3. The date of submission of the claims shall be determined as indicated below:

1.

|

In the case of Officers who are their own The date of presentation of the claim at the

Controlling Officer.

|

Treasury/Cash Section.

|

2.

|

In the case of Officers who are not their own

Controlling Officer. |

The date of submission of the claim to the Head of Office/Controlling Officer.

|

4. In the case of claims falling under category 3(ii), which are presented to the Treasury after a period of sixty days succeeding the date of completion of journey, the date of submission of the claim will be counted from the date when it was submitted by the Govt. servant to the Head of Office/ Controlling Officer within prescribed time-limit of sixty days.

5. A claim for Travelling Allowance of a Govt. servant which has been allowed to remain in

abeyance for a period exceeding one year should be investigated by the Head of the Department concerned. if the Head of Department is satisfied about the genuineness of the claim on the basis of the supportive documents and there are valid reasons for the delay in preferring the claims, the claims should be paid by the Drawing and Disbursing Officer or Accounts Officer, as the case may be, after usual checks.

abeyance for a period exceeding one year should be investigated by the Head of the Department concerned. if the Head of Department is satisfied about the genuineness of the claim on the basis of the supportive documents and there are valid reasons for the delay in preferring the claims, the claims should be paid by the Drawing and Disbursing Officer or Accounts Officer, as the case may be, after usual checks.

6. These orders are not applicable in r/o Leave Travel Concession (LTC) claims which are governed by separate set of rules of DoPT.

7. These orders shall be effective from the date of issue of this O.M.

8. In so far as the persons serving in the Indian Audit & Accounts Department are concerned, this order issues in consultation with the Comptroller & Auditor General of India.

S/d,

(Nirmala Dev)

Deputy Secretary to the Government of India

(Nirmala Dev)

Deputy Secretary to the Government of India

To,

All Ministries/Departments of the Govt. of India etc. as per standard distribution list.

DOWNLOAD Signed copy.

All Ministries/Departments of the Govt. of India etc. as per standard distribution list.

DOWNLOAD Signed copy.

Tuesday, 13 March 2018

SB Order No.03/2018 - Prevention of Frauds

SB Order No.03/2018 - Prevention of Frauds

F.No.113-01/2017-SB

Government of India

Ministry of Communications

Department of Posts

F.No.113-01/2017-SB

Government of India

Ministry of Communications

Department of Posts

Dak Bhawan, Sansad Marg,

New Delhi-110 001

Dated: 12.03.2018

To,

All Heads of Circles/Regions

Addl. Director General, APS, New Delhi.

Subject:-Prevention of Frauds

Respected Sir / Madam,

The undersigned is directed to refer to the Sr. DDG & CVO, Department of

Posts,Dak Bhawan, New Delhi, D.O. No.4-102/WB-08/2017-Inv dated 16.02.2018

addressed to the Circles, with copy marked to this Division and to say that various

guidelines/orders/instructions as well as SB Order have been issued to the Circles

from this end from time to time to ensure preventive vigilance in POSB/CBS for

prevention/early detection of Frauds. lt is once again requested to take up it as a

very important issue & to ensure necessary action in this regard. Vigilance Dn. has

given special emphasis on the following points:-

A) The PMLA alert are important & action thereon should be taken very

attentively & carefully at field level.

B) The 100% verification of SB transaction should be invariably done through

MIS server by SBCO as prescribed.

2. It is requested to circulate this to all concerned immediately for necessary

action accordingly.

This issues with the approval of competent authority.

Yours Sincerely,

(P L Meena)

Assistant Director (SB-I)

Monday, 1 January 2018

Saturday, 16 December 2017

Pension Arrears Calculator for Pre-2016 Pension Revision Cases

Pension Arrears Calculator for Pre-2016 Pension Revision Cases

A simple excel tool to Calculate Arrears of Pre-2016 Pension Revision cases

Download Link

A simple excel tool to Calculate Arrears of Pre-2016 Pension Revision cases

Download Link

Saturday, 11 November 2017

Revised the House Building Advance (HBA) rules for Central Government Employees incorporating the accepted recommendations of the 7th Pay Commission

Revised the House Building Advance (HBA) rules for Central Government Employees incorporating the accepted recommendations of the 7th Pay Commission

Press Information Bureau

Government of India

Ministry of Housing & Urban Affairs

09-November-2017 18:33 IST

House Building Advance 2017

The Government has revised the House Building Advance (HBA) rules for Central Government Employees incorporating the accepted recommendations of the 7th Pay Commission. Following are the salient features of the new rules:-

1. The total amount of advance that a central government employee can borrow from government has been revised upwards. The employee can up to borrow 34 months of the basic pay subject to a maximum of Rs. 25 lakhs (Rs. Twenty Five Lakhs only), or cost of the house/flat, or the amount according to repaying capacity, whichever is the least for new construction/purchase of new house/flat. Earlier this limit was only Rs.7.50 lakhs.

2. Similarly, the HBA amount for expansion of the house has been revised to a maximum of Rs.10 lakhs or 34 months of basic pay or cost of the expansion of the house or amount according to repaying capacity, whichever is least. This amount was earlier Rs.1.80 lakhs.

3. The cost ceiling limit of the house which an employee can construct/ purchase has been revised to Rs.1.00 crore with a proviso of upward revision of 25% in deserving cases. The earlier cost ceiling limit was Rs.30 lakhs.

4. Both spouses, if they are central government employees, are now eligible to take HBA either jointly, or separately. Earlier only one spouse was eligible for House Building Advance.

5. There is a provision for individuals migrating from home loans taken from Financial Institutions/ Banks to HBA, if they so desire.

6. The provision for availing ‘second charge’ on the house for taking loans to fund balance amount from Banks/ Financial Institutions has been simplified considerably. ‘No Objection Certificate’ will be issued along with sanction order of HBA, on employee’s declaration.

7. Henceforth, the rate of Interest on Housing Building Advance shall be at only one rate of 8.50% at simple interest (in place of the earlier four slabs of bearing interest rates ranging from 6% to 9.50% for different slabs of HBA which ranged from Rs.50,000/- to Rs.7,50,000/-) .

8. This rate of interest shall be reviewed every three years. All cases of subsequent tranches/ installments of HBA being taken by the employee in different financial years shall be governed by the applicable rate of interest in the year in which the HBA was sanctioned, in the event of change in the rate of interest. HBA is admissible to an employee only once in a life time.

9. The clause of adding a higher rate of interest at 2.5% (two point five percent) above the prescribed rate during sanction of House Building Advance stands withdrawn. Earlier the employee was sanctioned an advance at an interest rate of 2.5% above the scheduled rates with the stipulation that if conditions attached to the sanction including those relating to the recovery of amount are fulfilled completely, to the satisfaction of the competent authority, a rebate of interest to the extent of 2.5% was allowed.

10. The methodology of recovery of HBA shall continue as per the existing pattern recovery of principal first in the first fifteen years in 180 monthly installments and interest thereafter in next five years in 60 monthly installments.

11. The house/flat constructed/purchased with the help of House Building advance can be insured with the private insurance companies which are approved by Insurance Regulatory Development Authority (IRDA).

12. This attractive package is expected to incentivize the government employee to buy house/ flat by taking the revised HBA along with other bank loans, if required. This will give a fillip to the Housing infrastructure sector.

***

RJ/Chanda/

Source : http://pib.nic.in/newsite/PrintRelease.aspx?relid=173355

Wednesday, 23 August 2017

7th Pay Commission Travelling Allowance – Composite Transfer Grant and personal effect transportation – Clarification

7th Pay Commission Travelling Allowance – Composite Transfer Grant and personal effect transportation – Clarification

F.No. 19030/1/2017-E.IV

Government of India

Ministry of Finance

Department of Expenditure

Government of India

Ministry of Finance

Department of Expenditure

New Delhi, the 18th August, 2017

OFFICE MEMORANDUM

Subject:- Travelling Allowance Rules – Implementation of the Recommendations of the Seventh Central Pay Commission Consequent upon the issuance of this Departments O.M. of even number dated 13.07.2017 regarding implementation of recommendations of 7th CPC on Travelling Allowance (TA), various references are being received in this Department seeking clarifications regarding admissibility of Composite Transfer Grant (CTG) and TA/Daily Allowance (DA).

2. The matter has been considered in this Department and with the approval of Competent Authority, it has been decided that admissibility of CTG and Transportation of personal effects on Transfer and Retirement will be regulated as under:-

i. In case, the employee has been transferred prior to 01.07.2017 and has assumed charge prior to 01.07.2017, the employee will be eligible for CTG at pre-revised scale of pay. If the personal effects have been shifted after 01.07.2017, revised rates for transportation of personal effects will be admissible.

ii. In case, the employee has been transferred prior to 01.07.2017 and has assumed charge on/after 01.07.2017, the employee will be eligible for CTG at revised scale of pay. As the personal effects would be shifted after 01.07.2017, revised rates for transportation of personal effects will be admissible.

iii. In case of retirement, if an employee has retired prior to 01.07.2017, the employee will be eligible for CTG at pre-revised scale of pay. If the personal effects have shifted after 01.07.2017, revised rates for transportation of personal effects will be admissible.

Hindi version is attached.

sd/-

(Nirmala Dev)

Deputy Secretary to the Government of India

(Nirmala Dev)

Deputy Secretary to the Government of India